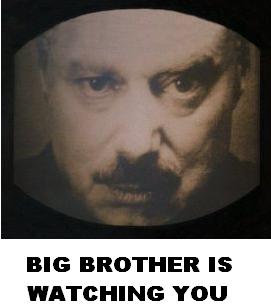

Those of you who enjoy interacting with the taxman, may be pleased to hear that you may have even more opportunities to "interact" with him in the future.

Seemingly taxpayers may have their phones tapped and their homes bugged in the future, if new surveillance powers are granted to HM Revenue & Customs tax inspectors.

Nanny's chums in HMRC claim that inspectors need such powers to tackle the growing threat from organised and white-collar crime.

Needless to say not everyone is convinced, lawyers and accountants argue that these powers could breach human rights rules.

Harry Travers, a solicitor who specialises in defending clients targeted by HMRC, says that the new powers were a possible breach of the European Convention on Human Rights.

Quote:

"A number of Customs and Excise prosecutions have spectacularly collapsed

in recent years due to the abuse by officers of their powers,

not because their powers were inadequate."

Nanny's chums in the HMRC are nonplussed by the objections. A spokesman for HMRC claims that the new powers for bugging are a rational move, after the merger of Customs and the Inland Revenue in 2005.

Oh joy!

As I recall HM customs and Excise had and still have some of the least regulated powers in the land with little if any recourse to complaint.

ReplyDeleteIt is of course entirely natural that the Inland Revenue part of this amalgam, despite some fairly draconian powers of its own, anticipate with glee the prospect of being allowed to operate like HMRC has done years. One can only pecualte about who thought it would ba a really good idea to bring these two organisation into this sort of marriage on the scale to which it applies.

And why they thought it such a good idea.

The only things that worries this juggernaut, at the moment or so I hear, is the fact that they now have to answer to the IPCC if any member of the public complains about the way they were treated during an investigation.

So if someone swears at you or tries to bully you at an individual level, you can complain via the offices of the IPCC. However, if they ask you where the 5 million went and why you did not pay tax on it when you have no idea what they are talking about you are on your own. As I understand it.

Seems to me that one mght as well be an employee of the state and totally reliant upon it so that the risk of anyone even THINKING you may have some other funds to hide is dramatically reduced. Or would be if any of their systems worked.

Grant

I really do promise to keep quiet after this, BUT:

ReplyDeleteSurely, if you were suspected of having hidden five million quid, it wouldn't be Customs & Excise, or the Revenue who would be interviewing you, it would be Lord Levy.

grumpy said...

ReplyDelete" I really do promise to keep quiet after this, BUT:

Surely, if you were suspected of having hidden five million quid, it wouldn't be Customs & Excise, or the Revenue who would be interviewing you, it would be Lord Levy. "

Exactly!

Levy knows you never had the cash and certainly haven't got it now, but the absence of Levy visiting you according to the HMRC surveillance records is probably not a full proof of innocence!

As a former colleague of mine observed after an experience back in the days of the IR regime, when the Tax Inspector demands a fairly large sum based on income the IR claims one has received but not handed over the tax cash it can be rather difficult to prove them wrong.

'Prove that you did not do the work' was the retort. Kind of truicky since by the time it came up both his then employer and the alleged client had sunk into insolvency, it being the early days of the computer industry boom and thus many companies overtrading.

It took years to get his tax code straightened out.

Just get Teflon Tone as your accountant - nothing would stick!!

ReplyDelete